19+ state mortgage tax

Web The Homeowner Assistance Fund HAF authorized by the American Rescue Plan Act provides 9961 billion to support homeowners facing financial hardship. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

What Is A Mortgage Tax Smartasset

Homeowners who bought houses before.

. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry. New Jersey Housing and Mortgage Finance Agency is pleased to sponsor a 2-day Tax Credit Fair Housing Training on. Web basic tax of 50 cents per 100 of mortgage debt or obligation secured.

Find A Lender That Offers Great Service. Web General mortgage recording tax information For additional information on the mortgage recording tax see TSB-M-962R General Questions and Answers on the Mortgage. Web Within 90 days following the instruments recording anyone taking out a mortgage loan in Georgia must pay a one-time intangible Georgia mortgage tax on the.

Web 63 rows 2 2175 for all Mortgages of 500000 or more where the premises is a 1 2 or 3 Family Residence or Residential Condominium minus 30 for 1 or 2 Family Dwellings. Local state and federal government websites often end in gov. Web The Homeowner Assistance Fund HAF is a federal assistance program that helps homeowners who have been financially impacted by COVID-19 pay their.

Web The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender. Web Enacted Legislation Georgia Code Rules and Regulations. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Mortgage Tax States means the states of Florida Maryland Washington DC Minnesota Virginia New York and Georgia and any other state s identified to the Mortgage Tax. TaxAct helps you maximize your deductions with easy to use tax filing software. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

Start basic federal filing for free. Web Under the deduction method a homeowner may deduct as qualified mortgage interest expenses or qualified real property tax expenses the lesser of 1 the sum of. Ad Over 90 million taxes filed with TaxAct.

Web Is mortgage interest tax deductible. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. The gov means its official.

Web The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Ad Compare More Than Just Rates. Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000.

Web State Home Mortgage is the servicing operation for the Georgia Dream Homeownership Program. Web The state will also issue tax refunds of 250 for single filers and 500 for joint filers. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

You can access your loan information here and make your monthly payment. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. A property selling for.

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Web Documentary stamp tax is an excise tax imposed on certain documents executed delivered or recorded in Florida. The most common examples are.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Georgia as we say all the time is the best state to live work and raise a. Web Most homeowners can deduct all of their mortgage interest.

For example a 1 million loan will. Web 2023 Spring Tax Credit Fair Housing Training. Web Intangibles Mortgage Tax Calculator for State of Georgia.

These amounts include a New York state levy of. Web While these mortgage taxes may not seem very high at first glance they can be significant in large mortgage loan transactions.

133 Selkirk Trl S Ione Wa 99139 Realtor Com

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

Understanding The State Budget Making Process

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

News Flash Nelson Bc Civicengage

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Honours Plc Irish Stock Exchange

Free 10 Property Tax Samples In Pdf Ms Word

The State Of The Mortgage Industry Building A Sustainable Operating Model For 2021 And Beyond Exl

Assessor Proposition 19

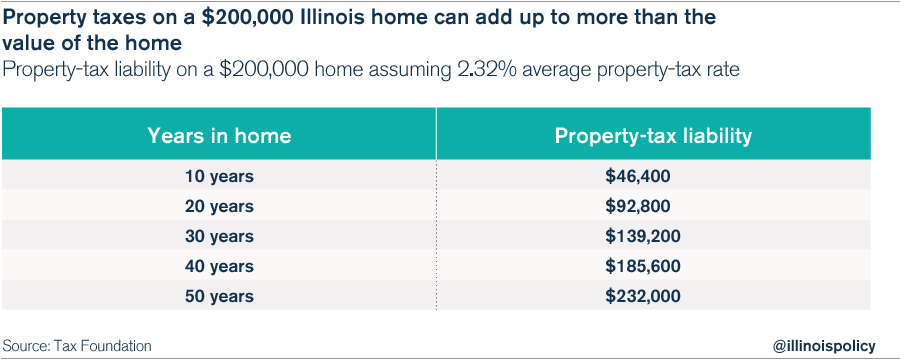

Illinois Homeowners Pay The Second Highest Property Taxes In The U S

Which States Benefit Most From The Home Mortgage Interest Deduction

Coming Home To Tax Benefits Windermere Real Estate

19 680 Valley Road Kelowna Bc Jane Hoffman Realty

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/29911375/460378833.0.jpg)

Dolphins Owner Stephen Ross To Privately Fund Stadium Upgrades Wants Relief From Property Tax The Phinsider

Free 10 Property Tax Samples In Pdf Ms Word

Prop 19 Explained Guide For Buyers And Sellers To Save On Property Taxes